As a travel enthusiast and mother, I know how exhilarating it can be to explore new places with your family. From hiking through lush forests to building sandcastles on the beach, there are countless memories waiting to be made.

However, as much as we may want our travels to go smoothly, sometimes life has other plans. This is why family travel insurance is an essential part of any trip planning process.

Whether it’s a missed connection or a sudden illness, unexpected events can quickly turn into costly emergencies when you’re away from home. This is where family travel insurance comes in – providing peace of mind and financial protection for you and your loved ones during your travels.

In this article, we’ll explore the importance of family travel insurance, coverage options, tips for choosing the right provider, and strategies for maximizing your coverage so that you can enjoy every adventure without worrying about what might happen along the way.

The Importance of Family Travel Insurance

You know how unpredictable life can be, especially when you’re planning a trip with your loved ones. That’s why family travel insurance is a must-have for any family vacation. It provides peace of mind knowing that unexpected events won’t ruin your trip and leave you stranded in unfamiliar territory.

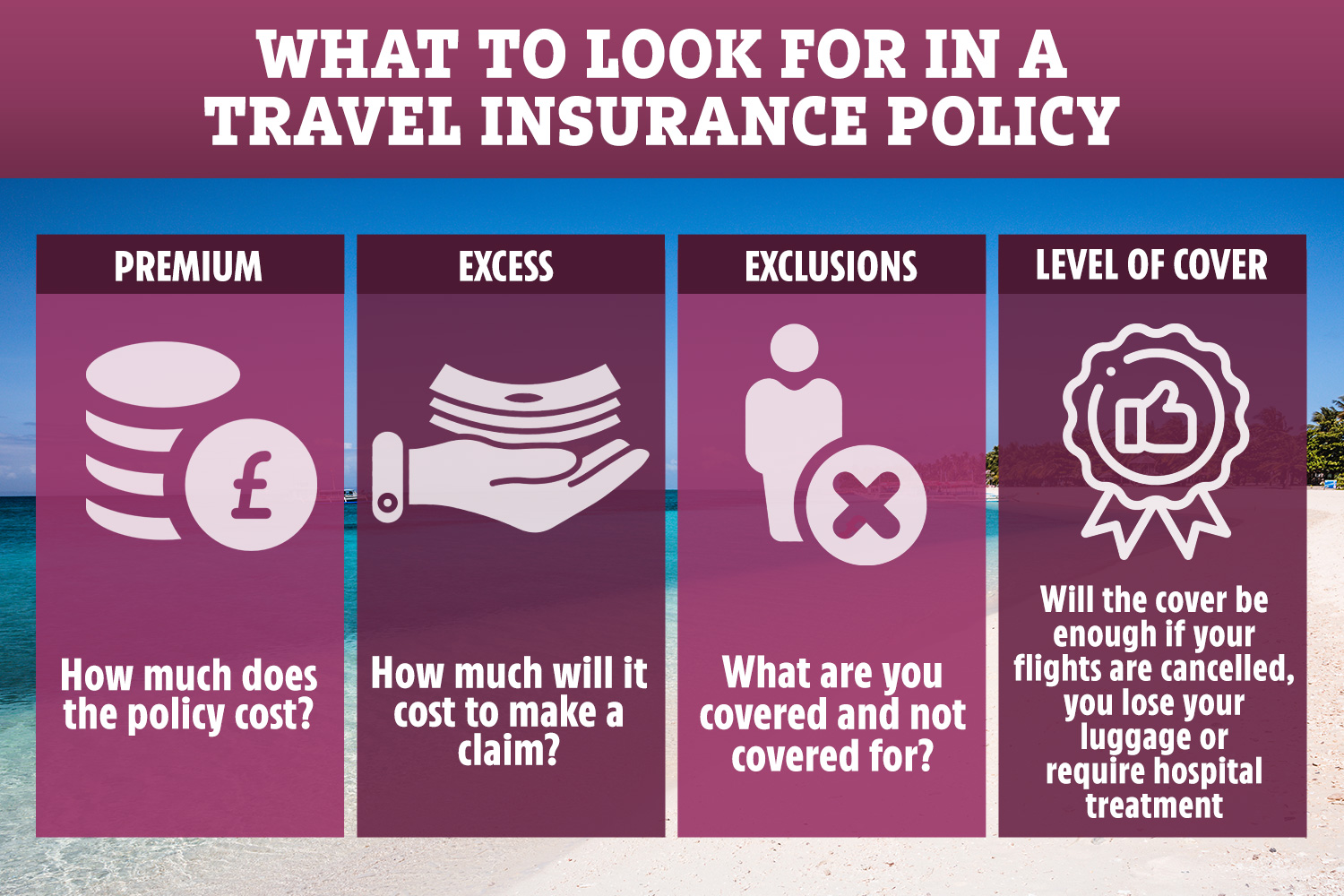

When it comes to choosing the right family travel insurance, it’s important to compare providers and understand the benefits and limitations of each policy. Some policies may cover medical emergencies but not lost luggage or cancelled flights, while others may provide coverage for all three. By understanding what each policy covers, you can choose the one that best fits your family’s needs and budget.

With so many options available, it’s easy to find the perfect coverage for your next adventure without breaking the bank. So let’s explore some coverage options to help you make an informed decision on which plan suits you best!

Coverage Options

In this section, we’ll explore all the different options for coverage, so you can have peace of mind knowing your loved ones are protected.

Trip cancellation is a common concern for families planning a vacation. With family travel insurance, you can get reimbursed for non-refundable expenses if you need to cancel or cut short your trip due to medical emergencies or unforeseen circumstances like a natural disaster affecting your destination.

Medical expenses are another important consideration when it comes to choosing the right family travel insurance. It’s crucial to make sure that medical coverage is included in your policy because healthcare costs can be exorbitant in some countries. Look for policies that cover emergency medical expenses such as hospitalization, ambulance services, and doctor visits. Additionally, check if pre-existing conditions are covered and if there are any exclusions related to dangerous activities like skiing or scuba diving.

When it comes to choosing the right insurance provider for your family, there are many factors to consider beyond just price.

Choosing the Right Insurance Provider

Looking for the perfect insurance provider is like searching for a needle in a haystack, but we’ll help you find one that fits your family’s needs. When choosing the right insurance provider, it’s important to compare prices and understand policy terms. Don’t just settle for the cheapest option; make sure you have enough coverage to protect your family from unexpected mishaps while traveling. It’s also crucial to read through the policy details carefully. Some policies may exclude certain activities or destinations, so be aware of what exactly is covered before making a decision.

To help evoke an emotional response in our audience, here is a comparison table of two different insurance providers:

| Provider A | Provider B | |

|---|---|---|

| Price (for one week) | $50 | $80 |

| Coverage Limit | $100,000 | Unlimited |

| Emergency Medical Evacuation Coverage | Included | Not Included |

| Adventure Sports Coverage | Not Included | Included |

| Destination Exclusions (e.g. war zones) | None Listed | Listed |

As you can see, there are significant differences between these two providers in terms of price and coverage options. It’s important to weigh these factors against your family’s specific needs when choosing an insurance provider.

When it comes to family travel insurance, finding the right provider can give you peace of mind during your trip. Understanding policy terms and comparing prices will ensure that you get the coverage that best suits your needs. Now let’s move on to some tips for maximizing your coverage during your travels!

Tips for Maximizing Your Coverage

Get the most out of your coverage by following these tips for maximizing it during your travels.

First, make sure to read and understand the claim process before you leave. Familiarize yourself with what documentation is required and how long it takes to process a claim. This will help you avoid any surprises or unnecessary delays in case you need to file a claim while on vacation.

Secondly, be aware of common exclusions in your policy. For example, some policies may not cover extreme sports or pre-existing medical conditions. It’s important to know what situations are not covered so that you can plan accordingly or purchase additional coverage if necessary.

By taking these steps, you can rest assured that your family is protected while traveling without worrying about unexpected costs or hassles during the claims process.

As we wrap up our discussion on maximizing your family travel insurance coverage, keep in mind that proper planning and understanding of your policy is key. By doing so, you can fully enjoy your travels without stressing over what could happen if an accident occurs.

Now let’s move on to some final thoughts about the benefits of having family travel insurance for peace of mind during all your adventures!

Final Thoughts

As a parent, I understand the importance of planning a family vacation that’s not only enjoyable but also safe. That’s why choosing the right insurance coverage for your needs is crucial when traveling with kids.

In this discussion, we’ll explore tips on making the most of your family vacation. We’ll also discuss how to choose the best insurance coverage to ensure peace of mind during your travels.

Making the Most of Your Family Vacation

Enjoy every moment of your family vacation with these helpful tips and tricks! One of the best ways to make the most out of your trip is by choosing family-friendly destinations that offer budget-friendly activities. Look for places that have plenty of outdoor activities, such as climbing, hiking trails, beaches, or parks where you can enjoy a picnic.

You can also visit local museums, zoos, or aquariums that offer educational experiences for both kids and adults. Another way to maximize your vacation is by planning ahead and creating an itinerary that includes everyone’s interests. Make sure to leave some room for spontaneity and relaxation too though!

Remember that vacations are supposed to be fun and stress-free. By following these simple steps, you’ll be able to make unforgettable memories with your loved ones. Now let’s talk about choosing the right insurance coverage for your needs…

Choosing the Right Insurance Coverage for Your Needs

You’ll want to ensure that your trip is stress-free and worry less by picking the perfect insurance coverage that matches all your needs. Here are some tips to help you choose the right family travel insurance for your budget and lifestyle:

1. Consider your budget: Before choosing a policy, determine how much you’re willing to spend on coverage. Look for policies with reasonable premiums that offer adequate protection without breaking the bank.

2. Research different providers: Don’t settle for the first policy you come across – shop around and compare different providers. Look at customer reviews and ratings, coverage details, and any exclusions or limitations.

3. Determine what kind of coverage you need: Depending on where you’re traveling, you may need different types of insurance coverage (e.g., medical evacuation, trip cancellation/interruption). Make sure the policy covers everything you need.

4. Read the fine print: Be sure to read through all policy details carefully before purchasing anything to avoid any surprises later on down the road.

Frequently Asked Questions

What is the average cost of family travel insurance?

I was curious about the average cost of family travel insurance and did some research. Factors affecting cost include the length of your trip, number and ages of travelers, destination, and coverage options.

It’s important to compare providers, as costs can vary greatly. Some of the best providers for family travel insurance are Allianz Global Assistance, Travel Guard, and Travelex Insurance Services.

Don’t let unexpected mishaps ruin your family vacation – invest in travel insurance for peace of mind.

Are there any age restrictions for children covered under family travel insurance?

When it comes to family travel insurance, it’s important to understand the age limits and coverage extent for children.

Typically, there are no age restrictions for children covered under a family policy, but it’s important to check with your provider to confirm.

Coverage extent will vary depending on the policy, but most should cover medical emergencies and trip cancellations or interruptions.

It’s always wise to read the fine print and ask any questions you may have before purchasing a policy.

Knowing that your family is protected during your travels can provide peace of mind and allow for more freedom in exploring new destinations without worrying about potential mishaps.

Does family travel insurance cover pre-existing medical conditions?

Dealing with a medical emergency while on vacation is one of the worst things that can happen. The last thing you want to worry about is whether or not your travel insurance will cover pre-existing conditions.

Luckily, many family travel insurance policies do offer coverage for pre-existing medical conditions. This means that if someone in your family has a known health issue and experiences complications while traveling, you can rest assured that their medical expenses will be covered by your policy.

It’s important to read the fine print and understand exactly what is covered before purchasing a policy, but having this added protection can give you peace of mind while enjoying your trip.

Can family travel insurance cover cancellations due to work obligations?

As someone who loves to travel, I understand the frustration of having to cancel plans due to work commitments. Last minute cancellations can be stressful and costly, especially when it comes to family vacations.

That’s why it’s important to consider purchasing travel insurance that covers cancellations due to work obligations. With this type of coverage, you can have peace of mind knowing that if something unexpected comes up at work, your trip won’t go completely down the drain.

So even though it may seem like an added expense, investing in family travel insurance can actually save you money and make your travels more enjoyable in the long run.

Is adventure sports coverage included in family travel insurance plans?

Imagine yourself standing at the edge of a cliff, with nothing but the wind and your adrenaline pushing you forward. Adventure sports like these are exhilarating, but they also come with risks.

That’s where family travel insurance comes in. Not only does it provide medical coverage in case of injury, but many plans also include adventure sports coverage. This means that if you or a family member gets injured while participating in an adventure sport, such as bungee jumping or white water rafting, you’ll be covered.

The benefits of family travel insurance go beyond just medical coverage. It can also cover trip cancellations due to unforeseen circumstances and lost or stolen luggage.

So next time you’re planning an adventurous vacation, make sure to have family travel insurance for peace of mind and freedom to explore without worry.

Is it cheaper to get family travel insurance?

In my opinion as a digital nomad traveling with my family and kids, I suggest that yes it is cheaper to get a family travel insurance compared to purchasing separate policies for each family member.

Since it is designed to cover multiple dependents under one policy. You can also get a discount and other additional benefits that can save your money. However, it is case to case basis and there are things to consider since every family member has different needs.

Conclusion

So there you have it, folks. Family travel insurance isn’t something to be taken lightly. As parents, we want our children to experience the world and all its wonders, but we also want them to be safe and protected.

I like to think of family travel insurance as a safety net – much like the net below a tightrope walker. It’s not something you plan on using, but it’s comforting to know that it’s there just in case.

So before your next family adventure, take the time to research your coverage options and choose the right insurance provider for your needs. And remember, accidents can happen anywhere – even on monkey bars and in moments of mayhem – so don’t leave home without proper protection!